In the rapidly evolving world of digital collectibles, Non-Fungible Tokens (NFTs) have taken center stage. But what exactly are NFTs, and why are they creating such a buzz? Whether you’re a seasoned cryptocurrency enthusiast or just starting to dip your toes into the world of blockchain technology, this article will serve as your ultimate guide to understanding NFTs. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged, NFTs represent unique items or assets that cannot be replicated or replaced. This opens up a whole new realm of possibilities for artists, creators, and collectors, as they can now buy, sell, and trade digital items like art, music, videos, and even virtual real estate. But how do NFTs work? What makes them valuable? And what are the implications for the future of digital ownership? In this comprehensive guide, we will explore the intricacies of NFTs, their role in the art world, the environmental concerns surrounding their creation, and much more. Join us as we venture into the fascinating world of NFTs and unlock the potential of this groundbreaking technology.

How Do NFTs Work?

Understanding Blockchain Technology

At the core of NFTs lies blockchain technology, a decentralized and distributed ledger that records transactions across multiple computers. Unlike traditional databases managed by a central authority, blockchain offers a transparent and immutable record of transactions. Each block in the chain contains a list of transactions, and once a block is added, it cannot be altered without changing all subsequent blocks.

Key Features of Blockchain Technology:

- Decentralization: Eliminates the need for intermediaries by distributing data across a network.

- Transparency: Provides a transparent history of transactions, viewable by anyone on the network.

- Security: Ensures data integrity through cryptographic hashing and consensus mechanisms.

The Role of Smart Contracts

Smart contracts are self-executing contracts with the agreement directly written into code. They automatically enforce and execute the terms of a contract when predetermined conditions are met, eliminating the need for intermediaries.

Functionality of Smart Contracts in NFTs:

- Automation: Facilitates automated transactions, reducing the need for manual intervention.

- Trust: Creates trustless environments where parties can transact without knowing each other.

- Efficiency: Increases transaction speed and reduces costs by automating processes.

Token Standards: ERC-721 and Beyond

The majority of NFTs are built on Ethereum using the ERC-721 standard, which defines a unique, non-fungible token. ERC-721 ensures that each token is distinct, providing unique ownership records.

Other Token Standards:

- ERC-1155: Allows for both fungible and non-fungible tokens within a single contract, enhancing efficiency.

- Flow: Developed by Dapper Labs, this blockchain is optimized for high performance and scalability, commonly used in platforms like NBA Top Shot.

Minting NFTs

Minting is the process of creating a new NFT. It involves converting digital files (art, music, videos) into a cryptographic token recorded on the blockchain. This token represents ownership and can be transferred or sold.

Steps in Minting NFTs:

- Create Digital Asset: Develop the digital file to be tokenized.

- Select Marketplace: Choose a platform like OpenSea or Rarible.

- Upload and Mint: Upload the file to the marketplace and initiate the minting process, setting terms for ownership and resale royalties.

The Difference Between Fungible and Non-Fungible Assets

Fungible Assets: Definition and Examples

Fungible assets are items that are identical in value and interchangeable. They can be divided into smaller parts, and each part retains the same value as another.

Examples of Fungible Assets:

- Currencies: US Dollar, Euro.

- Cryptocurrencies: Bitcoin, Ethereum.

- Commodities: Gold, oil.

Non-Fungible Assets: Definition and Examples

Non-fungible assets are unique and cannot be exchanged on a one-to-one basis. Each asset has distinct characteristics that determine its value.

Examples of Non-Fungible Assets:

- Real Estate: Each property has unique attributes like location and size.

- Collectibles: Rare trading cards, antiques.

- Digital Assets: NFTs representing art, music, or virtual land.

Comparative Analysis

Fungible Tokens:

- Interchangeable: Each unit is identical and can be swapped with another of the same type.

- Divisibility: Can be divided into smaller units without losing value.

Non-Fungible Tokens:

- Unique: Each token is distinct and represents a unique item.

- Indivisible: Cannot be divided without losing its essence or value.

| Attribute | Fungible Assets | Non-Fungible Assets |

| Definition | Assets that are interchangeable and identical in value | Assets that are unique and cannot be exchanged one-to-one |

| Examples | Currencies (USD, Euro) – Cryptocurrencies (Bitcoin, Ethereum) – Commodities (Gold, Oil) | Real Estate – Collectibles (Trading Cards, Antiques) – Digital Assets (NFTs) |

| Interchangeability | Fully interchangeable; each unit is identical | Non-interchangeable; each unit is unique |

| Divisibility | Can be divided into smaller units without losing value | Cannot be divided without losing value or utility |

| Value Determination | Value is identical for each unit | Value is unique to each asset, based on its characteristics |

| Ownership Records | Typically not individually tracked; only quantity matters | Each asset has a distinct ownership record |

| Transferability | Easily transferable between parties without specific conditions | Transfer often involves specific conditions or contracts |

| Market Dynamics | Generally stable and liquid markets | Often illiquid, value can be volatile and speculative |

| Common Usage | Currency for transactions – Store of value – Investment | Unique ownership rights – Collection – Proof of authenticity |

| Risk Profile | Lower volatility, predictable value fluctuations | Higher volatility, value influenced by rarity and demand |

| Technology Use | Fungible tokens on blockchain (e.g., ERC-20 tokens) | Non-fungible tokens on blockchain (e.g., ERC-721, ERC-1155) |

Table Explanation:

- Definition: Fungible assets are those that can be replaced by another identical item; non-fungible assets are unique and not directly replaceable by another.

- Examples: Fungible assets include currencies and cryptocurrencies, while non-fungible assets include real estate, collectibles, and NFTs.

- Interchangeability: Fungible assets are interchangeable; non-fungible assets are unique.

- Divisibility: Fungible assets can be split into smaller parts without loss of value; non-fungible assets cannot.

- Value Determination: The value of fungible assets is the same across units; the value of non-fungible assets is unique to each.

- Ownership Records: Fungible assets typically do not require individual tracking; non-fungible assets have distinct ownership records.

- Transferability: Fungible assets can be easily transferred; non-fungible assets often involve more complex transfer conditions.

- Market Dynamics: Fungible assets generally have stable, liquid markets; non-fungible assets can have illiquid and volatile markets.

- Common Usage: Fungible assets are used in everyday transactions and as investments; non-fungible assets serve as proof of unique ownership and are often collected.

- Risk Profile: Fungible assets tend to have a lower risk profile; non-fungible assets can be more volatile.

- Technology Use: Fungible tokens use standards like ERC-20; non-fungible tokens use standards like ERC-721 and ERC-1155.

This table provides a concise comparison, making it easier to understand the fundamental differences between fungible and non-fungible assets.

Use Cases for NFTs

Digital Art and Collectibles

NFTs have revolutionized the art world by providing a way for artists to sell their work directly to collectors, without intermediaries. This new model empowers artists and ensures they can earn royalties from secondary sales.

Impact on Digital Art:

- Ownership Proof: Establishes ownership and provenance.

- Direct Sales: Artists can sell directly to consumers.

- Royalties: Automated royalties for secondary sales ensure continued earnings for artists.

Popular Digital Art Platforms:

- OpenSea: A leading marketplace for a wide range of digital assets.

- Foundation: Focuses on high-quality art with a curated selection.

Gaming and Virtual Goods

In the gaming industry, NFTs are used to represent in-game assets, such as characters, skins, and virtual real estate. Players can trade or sell these items, creating a secondary market for digital goods.

Examples of NFT Use in Gaming:

- Axie Infinity: Players collect, breed, and trade creatures called Axies.

- Decentraland: Users buy and develop virtual land parcels.

Music and Entertainment

Musicians and entertainers are leveraging NFTs to sell exclusive content, such as limited edition albums, concert tickets, and memorabilia. NFTs provide new revenue streams and ways to engage with fans.

Innovative Uses in Entertainment:

- Exclusive Access: NFTs can grant access to VIP events or exclusive content.

- Royalty Distribution: Automated royalty payments ensure fair compensation for creators.

Real Estate and Virtual Land

NFTs are making inroads in both physical and virtual real estate. In the physical realm, NFTs can represent ownership deeds or property records. In virtual worlds, NFTs signify ownership of land parcels that can be developed, sold, or rented out.

Applications in Real Estate:

- Property Deeds: Digitize and secure ownership records on the blockchain.

- Virtual Real Estate: Platforms like Decentraland and The Sandbox allow users to buy and develop virtual land.

Identity and Certification

NFTs can be used for identity verification and certification, providing secure and immutable records for credentials, educational certificates, and professional qualifications.

Benefits:

- Verification: Provides a tamper-proof way to verify identities or qualifications.

- Portability: Credentials stored as NFTs can be easily transferred or verified across platforms.

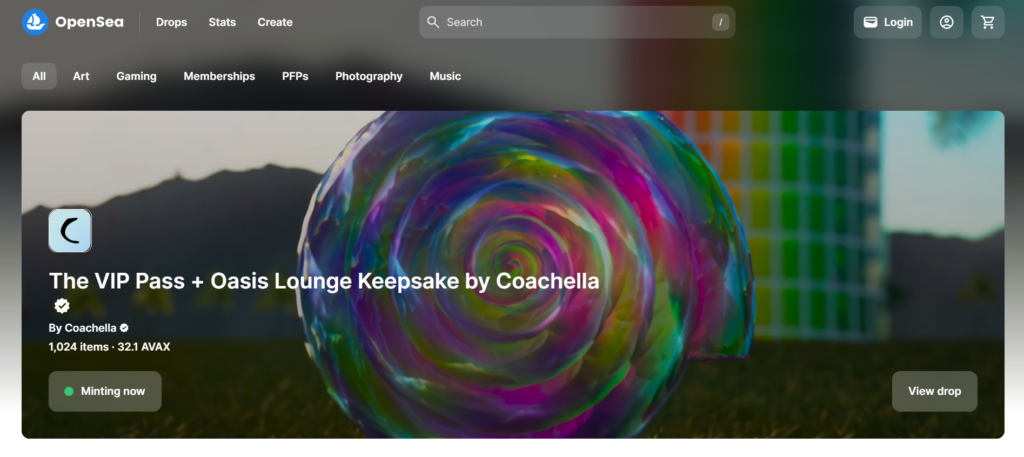

NFT Marketplaces and Platforms

Leading NFT Marketplaces

NFT marketplaces facilitate the creation, buying, and selling of NFTs. They provide a platform for artists, creators, and collectors to interact.

Top NFT Marketplaces:

- OpenSea: The largest NFT marketplace, supporting a wide range of assets.

- Rarible: A community-driven platform where users can mint, buy, and sell NFTs.

- Foundation: Known for its focus on high-quality digital art and a curated selection.

Platform Comparison

OpenSea:

- Features: User-friendly interface, wide range of assets.

- Fees: 2.5% transaction fee.

Rarible:

- Features: Community governance, customizable royalties.

- Fees: 2.5% transaction fee on both buyer and seller.

Foundation:

- Features: Curated art, invite-only for creators.

- Fees: 15% commission on sales.

Niche Marketplaces

Niche marketplaces cater to specific types of NFTs or communities, offering tailored experiences and specialized assets.

Examples:

- NBA Top Shot: Focuses on digital basketball collectibles.

- Axie Marketplace: Dedicated to Axie Infinity game assets.

Creating and Selling NFTs on Marketplaces

To create and sell NFTs, users must choose a marketplace, upload their digital assets, and mint their tokens. They can then list the NFTs for sale, either through auctions or fixed-price listings.

Process Overview:

- Choose a Marketplace: Select a platform based on the type of NFT and target audience.

- Upload Asset: Prepare and upload the digital file to the marketplace.

- Mint NFT: Convert the file into an NFT by minting it on the blockchain.

- List for Sale: Set terms, such as price and royalties, and list the NFT for sale.

Investing in NFTs

Evaluating NFTs: What to Look For

When evaluating NFTs for investment, consider factors such as the creator’s reputation, the uniqueness of the asset, and its potential for future appreciation. Research and due diligence are crucial to making informed investment decisions.

Key Evaluation Criteria:

- Creator Reputation: Established artists or creators with a track record of success.

- Rarity: The scarcity and uniqueness of the NFT.

- Utility: Potential uses or applications of the NFT.

- Community Support: A strong and engaged community can drive demand.

Risks and Rewards

Investing in NFTs offers high potential returns but also involves significant risks, including market volatility and the speculative nature of the assets.

Potential Rewards:

- High Returns: Successful investments can yield substantial profits.

- Diversification: NFTs can diversify investment portfolios.

Risks:

- Market Volatility: Prices can fluctuate dramatically based on trends and speculation.

- Liquidity: Some NFTs may be difficult to sell quickly.

Strategies for NFT Investment

Effective strategies for investing in NFTs include buying early in promising projects, focusing on well-known creators, and diversifying across different types of NFTs to mitigate risks.

Investment Strategies:

- Early Adoption: Investing in new projects or artists before they become widely popular.

- Blue Chip NFTs: Focusing on established and well-regarded creators or assets.

- Diversification: Spreading investments across various categories and types of NFTs.

Legal and Tax Considerations

NFTs are subject to various legal and tax regulations, including capital gains taxes. It’s essential to understand these regulations

to navigate the complexities of NFT investments and ensure compliance with applicable laws.

Key Considerations:

- Taxation: NFTs may be subject to capital gains taxes upon sale. The tax rate can vary based on the holding period and jurisdiction.

- Intellectual Property (IP): Understand the IP rights associated with the NFT. Ownership of an NFT does not necessarily grant copyright or IP rights to the underlying asset.

- Regulatory Compliance: Keep abreast of regulatory developments as governments and regulatory bodies increasingly focus on digital assets.

Also Read: The Ultimate Guide: How NFT Marketplaces Revolutionize the Art World

The Environmental Impact of NFTs

Energy Consumption of Blockchain Networks

One of the most pressing concerns surrounding NFTs is their environmental impact, primarily due to the energy consumption of blockchain networks like Ethereum, which use proof-of-work (PoW) consensus mechanisms.

Energy Impact:

- Proof-of-Work: Requires significant computational power to validate transactions, leading to high energy consumption.

- Carbon Footprint: The extensive energy use contributes to the carbon footprint, raising environmental concerns.

Sustainable Practices in NFTs

In response to environmental concerns, the NFT community and blockchain developers are exploring more sustainable practices and technologies.

Sustainability Initiatives:

- Proof-of-Stake (PoS): A consensus mechanism that requires less energy than PoW. Ethereum’s transition to PoS with Ethereum 2.0 aims to reduce its energy consumption.

- Carbon Offsets: Some platforms and creators purchase carbon offsets to mitigate their environmental impact.

- Eco-Friendly Blockchains: Alternatives like Flow and Tezos use more energy-efficient consensus mechanisms.

Innovations and Alternatives

Innovative solutions and alternative blockchains are being developed to address the environmental impact of NFTs and make the ecosystem more sustainable.

Emerging Technologies:

- Layer 2 Solutions: Off-chain scaling solutions that reduce the load on the main blockchain, decreasing energy consumption.

- Interoperability: Projects aimed at enabling NFTs to operate across multiple blockchains, enhancing flexibility and efficiency.

- Energy-Efficient Blockchains: Blockchains like Cardano and Algorand are designed to be more energy-efficient from the outset.

Challenges and Controversies Surrounding NFTs

Market Volatility

The NFT market is characterized by high volatility, with prices subject to rapid and significant changes based on trends, speculation, and market sentiment.

Volatility Factors:

- Speculative Investments: High levels of speculation can lead to sharp price increases and subsequent drops.

- Market Trends: Popularity and media attention can drive short-term demand, affecting prices unpredictably.

Intellectual Property Issues

NFTs often raise complex intellectual property (IP) issues, as ownership of an NFT does not necessarily convey copyright or other IP rights to the underlying digital asset.

Common IP Challenges:

- Unauthorized Minting: Instances where individuals mint NFTs of digital assets without the creator’s permission.

- Rights Clarification: The need for clear communication about what rights are transferred when an NFT is purchased.

Fraud and Scams

The rapid growth of the NFT market has attracted fraudulent activities, including fake NFTs, phishing scams, and fraudulent projects.

Types of Scams:

- Counterfeit NFTs: Fraudsters creating and selling unauthorized copies of popular NFTs.

- Phishing: Scammers tricking users into revealing their private keys or login credentials.

Preventive Measures:

- Due Diligence: Verify the authenticity of NFTs and the credibility of platforms.

- Secure Wallets: Use secure, reputable digital wallets to store NFTs.

Ethical Considerations

NFTs also raise ethical questions about the commodification of digital art and content, as well as the implications of creating and trading digital assets in a speculative market.

Ethical Concerns:

- Artist Exploitation: Potential for artists to be exploited through unfair practices or terms.

- Speculative Bubbles: Risk of market bubbles driven by speculation rather than intrinsic value.

The Future of NFTs

Technological Advancements

The future of NFTs will be shaped by ongoing technological advancements in blockchain and related technologies, enhancing their functionality, scalability, and usability.

Anticipated Developments:

- Scalability Solutions: Technologies to improve transaction speed and reduce costs.

- Interoperability: Enhanced interoperability between different blockchain networks, allowing NFTs to move seamlessly across platforms.

- Smart Contract Innovations: More sophisticated smart contracts enabling complex and flexible transactions.

Integration with Other Technologies

NFTs are expected to integrate with other emerging technologies such as augmented reality (AR), virtual reality (VR), and artificial intelligence (AI), expanding their potential applications.

Integration Possibilities:

- AR/VR: NFTs can be used in AR/VR environments for virtual goods, real estate, and experiences.

- AI: AI can enhance the creation and management of NFTs, including generative art and automated trading systems.

Mainstream Adoption

As the technology matures and understanding of NFTs increases, mainstream adoption across various industries is likely to grow, including entertainment, real estate, fashion, and more.

Industries Poised for Adoption:

- Entertainment: Use of NFTs for ticketing, fan engagement, and content distribution.

- Real Estate: Digital representation of property deeds and smart contracts for real estate transactions.

- Fashion: Digital fashion items and virtual try-on experiences powered by NFTs.

Regulatory Developments

Regulatory frameworks for NFTs are still evolving, with significant implications for their trading, taxation, and integration into the broader financial system.

Regulatory Trends:

- Taxation: Clarity on the taxation of NFT transactions, including capital gains.

- Compliance: Development of standards and regulations to protect consumers and ensure fair practices.

Conclusion: The Potential of NFTs in the Digital World

NFTs represent a transformative force in the digital world, offering new ways to own, trade, and interact with digital assets. Despite challenges and controversies, the potential for innovation and growth in NFTs is vast, promising exciting possibilities for creators, investors, and consumers alike.

The technology behind NFTs continues to evolve, addressing environmental concerns and expanding into new applications. As mainstream adoption grows and regulatory frameworks develop, NFTs are set to play an increasingly significant role in the digital economy, offering unprecedented opportunities for digital ownership and interaction.

FAQs

What are NFTs?

NFTs, or Non-Fungible Tokens, are digital assets that represent ownership of unique items or content on the blockchain. Unlike cryptocurrencies, which are fungible and interchangeable, NFTs are indivisible and have distinct values.

How do NFTs work?

NFTs operate on blockchain technology, which ensures transparent and secure ownership records. They use smart contracts to automate transactions and enforce terms, and are typically minted using standards like ERC-721 on Ethereum.

What can NFTs be used for?

NFTs have diverse applications, including digital art, gaming assets, virtual real estate, music, entertainment, and identity verification. They enable creators to monetize their work, and allow collectors to own and trade unique digital assets.

Where can I buy and sell NFTs?

NFTs can be bought and sold on various marketplaces such as OpenSea, Rarible, and Foundation. Each marketplace offers different features, fees, and types of NFTs, catering to different needs and preferences.

Are NFTs a good investment?

NFT investments can be profitable but also come with risks due to market volatility and speculation. It’s essential to conduct thorough research, understand the market, and consider factors like the creator’s reputation and the uniqueness of the asset.

What are the environmental concerns associated with NFTs?

The environmental impact of NFTs primarily stems from the energy consumption of blockchain networks like Ethereum, which use proof-of-work consensus mechanisms. Efforts to reduce this impact include transitioning to proof-of-stake, using energy-efficient blockchains, and implementing carbon offset initiatives.

How are NFTs evolving?

NFTs are evolving through technological advancements, integration with AR/VR, and increased interoperability between blockchains. They are also gaining mainstream adoption across various industries, from entertainment to real estate, and are subject to emerging regulatory frameworks.