The cryptocurrency market is once again capturing attention with its recent upward trajectory, reflecting renewed optimism among investors. The total market capitalization of cryptocurrencies has surged by $15 billion within the last 24 hours, signaling a recovery that many view as a potential return to bullish momentum. This growth is not confined to a single asset but is distributed across various sectors, from Bitcoin’s relative stability to altcoins like Tron achieving explosive gains. For investors and enthusiasts, understanding the factors driving this surge is crucial to capitalizing on opportunities while mitigating risks in this volatile market.

This recent uptick comes at a time of significant milestones and challenges for the crypto space. Institutional involvement, regulatory developments, and advancements in blockchain technology are reshaping the market landscape. Simultaneously, events like the New York Stock Exchange’s filing for a Solana ETF and high-profile legal developments such as Celsius Network’s fallout provide a backdrop of complexity. These dynamics underline the importance of keeping a close eye on both internal market movements and external influences to make informed decisions in the ever-evolving world of cryptocurrency.

Market Trends Driving Growth

The cryptocurrency market is witnessing a notable recovery, with the total market capitalization climbing to $3.43 trillion. This represents a $15 billion increase in just 24 hours, highlighting renewed momentum and investor confidence. While the market is still shy of its all-time high of $3.49 trillion, the steady rise in value is a clear indicator of improved sentiment. If this trend continues, the market could soon surpass the critical $3.50 trillion threshold, marking a significant milestone for the industry.

Investor sentiment has played a pivotal role in this resurgence. Positive news, such as regulatory advancements and institutional interest, has strengthened market optimism. Institutional investors, in particular, are drawn by the potential for high returns and the increasing mainstream adoption of blockchain technology. Products like exchange-traded funds (ETFs) for cryptocurrencies, including Bitcoin and Solana, further signal growing confidence. These developments not only bring more liquidity into the market but also offer a sense of legitimacy, encouraging both seasoned and new investors to participate in the crypto ecosystem.

- Advertisement -

This blend of strong market performance, rising institutional engagement, and positive investor sentiment underscores the potential for sustained growth in the cryptocurrency market.

Bitcoin’s Role in the Market

Bitcoin continues to be the cornerstone of the cryptocurrency market, demonstrating remarkable stability amidst a volatile environment. Currently priced at approximately $95,814, Bitcoin has shown little fluctuation over the past day, reflecting strong market confidence. This stability is crucial as it provides a foundation for the broader crypto market, with other cryptocurrencies often mirroring Bitcoin’s price movements. Investors are closely monitoring its progress, particularly as it inches closer to its all-time high of $99,595. Bitcoin’s ability to maintain this level of stability reinforces its position as a trusted asset in the digital currency space.

- Sponsored -

However, significant challenges remain as Bitcoin strives to breach the $100,000 psychological threshold. Achieving this milestone requires robust market conviction and a surge in liquidity. Increased institutional participation and sustained buying pressure are vital to drive prices upward. Conversely, external factors such as regulatory uncertainty or macroeconomic instability could dampen this momentum, preventing Bitcoin from breaking this critical barrier. The $100,000 level is more than a number—it symbolizes a new era of adoption and credibility for the crypto market.

Bitcoin’s support and resistance levels play a pivotal role in shaping market trends. With strong support established at $89,800, Bitcoin offers a safety net for investors, minimizing downside risks. On the flip side, resistance around $99,595 challenges upward movement, acting as a psychological barrier for traders. A sustained break above this level could ignite a new wave of bullish sentiment across the market, boosting altcoins and driving overall market capitalization higher. Conversely, a drop below support could trigger a wave of selling, impacting the broader crypto ecosystem. As the market’s bellwether asset, Bitcoin’s movements remain a critical factor in shaping the crypto market’s future.

Altcoins Leading the Surge

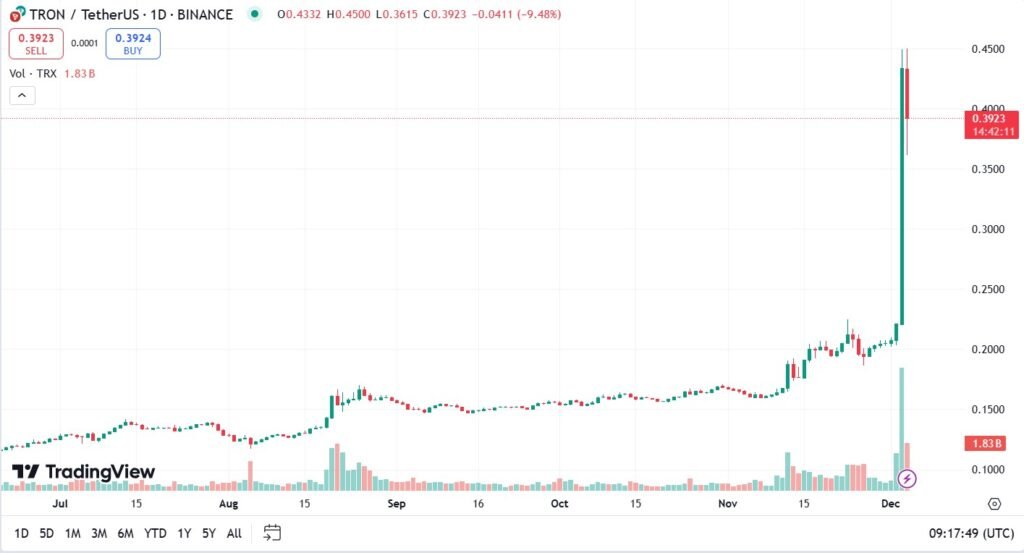

While Bitcoin often dominates the headlines, altcoins are currently stealing the spotlight with impressive gains, led by Tron (TRX). Tron recently experienced a meteoric rise of 103%, reaching a new all-time high of $0.45 before settling at $0.39. This extraordinary performance underscores the growing interest in altcoins as they continue to gain traction among investors seeking opportunities beyond Bitcoin and Ethereum. Tron’s surge is particularly significant because it reflects the increasing adoption of blockchain solutions and the potential of smaller cryptocurrencies to deliver exponential growth. With its innovative ecosystem and strong community support, Tron has positioned itself as a standout player in the crypto space.

However, the rapid growth of altcoins like Tron is not without risks. Profit-taking is a key concern, as investors who benefited from the recent price surge may choose to cash out, causing a sharp correction. Additionally, altcoins are inherently more volatile than larger cryptocurrencies like Bitcoin, making them susceptible to rapid price swings. Tron’s price fluctuations exemplify this, with an 8% dip following its recent peak. Such volatility can create uncertainty, especially for new investors who may be unprepared for sudden market changes.

Despite these risks, Tron’s strong fundamentals and its ability to capture market interest suggest that it could sustain its upward momentum in the long term. Investors are watching closely to see if Tron can consolidate its gains and establish support levels around $0.40, which would provide a solid foundation for future growth. For those willing to navigate the risks, altcoins like Tron offer significant potential for high returns in the ever-evolving cryptocurrency market.

Also Read: Riding the Crypto Wave: The Top 10 Meme Coins to Invest in 2024

External Factors Influencing the Market

External developments play a significant role in shaping the cryptocurrency market’s performance, driving both positive sentiment and caution. One major factor influencing the market today is regulatory progress, particularly with initiatives like the Solana ETF filings. The New York Stock Exchange recently filed to create an exchange-traded fund (ETF) based on Grayscale’s Solana Trust. This move signals the increasing interest in cryptocurrency-backed financial products, similar to the successful Bitcoin ETFs introduced earlier. If approved, a Solana ETF would not only increase institutional participation but also legitimize Solana as a top-tier blockchain asset. Such developments create a ripple effect of optimism, as investors view them as a sign of the market’s maturing infrastructure.

In addition to regulatory advancements, high-profile news also impacts market sentiment. For example, the ongoing developments surrounding Celsius Network have garnered widespread attention. Alex Mashinsky, co-founder of the now-defunct Celsius Network, recently pleaded guilty to fraud charges linked to the platform’s collapse. Mashinsky was accused of manipulating the price of Celsius’ native CEL token to mislead investors and profit personally. While this case highlights the risks of malpractice in the crypto industry, it also underscores the importance of regulatory oversight and transparency. Events like these remind investors to exercise caution and conduct thorough due diligence, even during bullish market trends.

These external factors collectively influence how the market evolves. Positive regulatory news, like ETF filings, bolsters confidence and encourages long-term investments. At the same time, cases of fraud and malpractice, such as the Celsius Network scandal, emphasize the need for vigilance. Together, these developments shape the broader perception of the cryptocurrency market, affecting both short-term movements and long-term growth prospects.

Risks and Future Outlook

The cryptocurrency market, despite its recent bullish momentum, is not immune to risks that could lead to potential corrections. Profit-taking remains one of the primary risks, especially after sharp price increases. When investors capitalize on their gains, it can trigger sell-offs, causing prices to dip significantly. Additionally, external factors such as regulatory uncertainties, macroeconomic pressures, or unexpected negative news could undermine market confidence, leading to a temporary downturn. For instance, a major correction in Bitcoin or other leading cryptocurrencies could cascade across the entire market, amplifying the volatility that often characterizes the crypto ecosystem.

Despite these short-term risks, the long-term outlook for cryptocurrencies remains optimistic. Increasing institutional adoption, the development of blockchain technologies, and the gradual acceptance of digital assets as part of mainstream financial systems all contribute to the sector’s growth potential. Regulatory advancements, such as ETF approvals and clearer guidelines, are also fostering a more stable and mature market environment. These developments not only attract new investors but also help build trust in the market’s long-term viability.

For investors, this dual reality underscores the importance of balancing caution with opportunity. Diversifying portfolios, staying informed about market trends, and focusing on projects with strong fundamentals are strategies that can help mitigate risks while leveraging growth opportunities. As blockchain technology continues to innovate and global adoption expands, the crypto market’s long-term growth prospects remain bright, positioning it as a transformative force in the global financial landscape.

Conclusion

The cryptocurrency market is experiencing a dynamic phase, driven by a mix of bullish trends, regulatory advancements, and increasing institutional interest. While Bitcoin maintains its status as the market’s foundation, altcoins like Tron are showcasing their potential for explosive growth, underscoring the diverse opportunities within the sector. Positive developments, such as the filing of Solana ETFs, demonstrate a growing acceptance of cryptocurrencies in mainstream finance, signaling a maturing market.

However, investors must navigate this landscape with care. Risks like profit-taking, market corrections, and regulatory uncertainties can lead to short-term volatility. Despite these challenges, the long-term prospects for the crypto market remain robust, bolstered by ongoing technological innovation and rising adoption. Staying informed and adopting a strategic investment approach can help participants capitalize on the immense potential of this transformative market while mitigating associated risks.