The cryptocurrency market experienced a significant downturn in July 2024, wiping out approximately $90 billion from the global market cap within hours. This crash, characterized by steep declines in Bitcoin and altcoins, has sent shockwaves through the crypto community. Understanding the factors that triggered this market upheaval and its broader implications is crucial for investors and enthusiasts alike. In this article, we delve into the causes of the crash, its impact, and what it means for the future of cryptocurrencies.

Causes of the Cryptocurrency Market Crash

1. Regulatory Pressures

One of the primary drivers behind the July 2024 cryptocurrency market crash is increased regulatory scrutiny. Governments worldwide, including the United States, European Union, and China, have introduced stricter regulations on cryptocurrency trading, taxation, and anti-money laundering measures. The fear of impending regulatory crackdowns has led to panic selling among investors, contributing to the market’s downfall.

2. Macroeconomic Factors

The global macroeconomic environment has also played a crucial role in the crypto market’s decline. Rising interest rates, inflation concerns, and fears of a global recession have prompted investors to shift their capital away from high-risk assets like cryptocurrencies. This flight to safety has exacerbated the sell-off, further depressing crypto prices.

3. Market Manipulation and Whales

Market manipulation by large holders, or “whales,” is another factor contributing to the crash. These entities have the power to influence market trends by executing large buy or sell orders. During the recent crash, several whale accounts offloaded substantial amounts of Bitcoin and altcoins, triggering a cascade of sell orders from retail investors and algorithmic trading bots.

- Advertisement -

4. Technical and Sentiment Analysis

Technical indicators also signaled a bearish trend prior to the crash. Key support levels for Bitcoin and major altcoins were breached, leading to a loss of confidence among traders. Additionally, negative sentiment on social media platforms and crypto forums amplified fears, leading to a self-reinforcing cycle of selling pressure.

5. Exchange-Related Issues

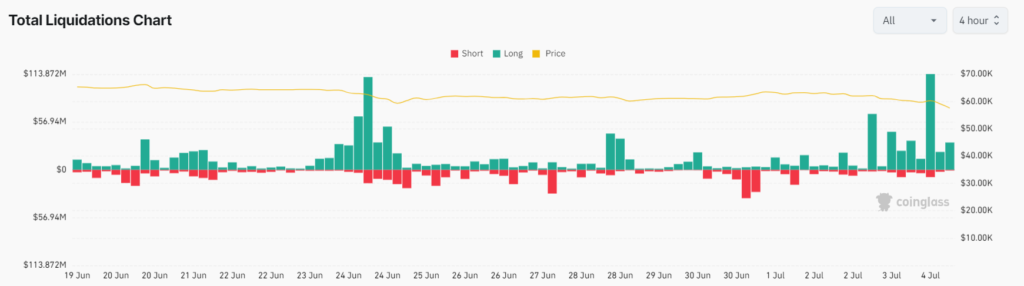

Technical issues and outages on major cryptocurrency exchanges during periods of high volatility have exacerbated the market’s decline. In July 2024, several exchanges experienced service interruptions, leading to liquidity problems and forced liquidations of leveraged positions. These disruptions further intensified the market’s downward momentum.

- Sponsored -

Impact on the Cryptocurrency Market

1. Market Capitalization

The immediate impact of the crash was a sharp decline in the overall market capitalization of cryptocurrencies. Within hours, approximately $90 billion was erased from the global crypto market cap, leading to significant losses for investors.

2. Bitcoin’s Dominance

Bitcoin, the flagship cryptocurrency, saw its price drop significantly, dragging down the entire market. Bitcoin’s dominance over the crypto market increased as altcoins experienced even steeper declines, highlighting Bitcoin’s role as a market bellwether.

3. Altcoin Volatility

Altcoins, particularly those with smaller market caps, faced extreme volatility. Many experienced double-digit percentage losses, leading to heightened uncertainty and risk aversion among investors. This crash has demonstrated the inherent volatility and speculative nature of many altcoins.

4. Investor Sentiment

The crash has also impacted investor sentiment, leading to a heightened sense of caution. The psychological impact of such a sudden downturn can lead to a prolonged period of risk aversion and reduced trading volumes as investors reassess their strategies and risk tolerance.

Future Outlook

1. Regulatory Clarity

In the aftermath of the crash, there is an increasing demand for regulatory clarity. Investors and industry stakeholders are calling for clear guidelines that can provide a stable framework for cryptocurrency trading and investments. Effective regulation could help mitigate the impact of future market crashes by reducing uncertainty and promoting transparency.

2. Technological Innovations

Despite the crash, the underlying technology of cryptocurrencies continues to evolve. Innovations such as decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain scalability solutions offer new opportunities for growth and adoption. These advancements may help the market recover and grow in the long term.

3. Market Recovery Patterns

Historically, the cryptocurrency market has demonstrated a capacity for recovery following major crashes. While short-term volatility is likely to persist, the long-term outlook for the market may remain positive, driven by continued adoption and technological advancements.

4. Investor Education

The crash underscores the need for enhanced investor education. Understanding market dynamics, risk management, and the factors influencing cryptocurrency prices is essential for navigating the volatile crypto landscape. Educated investors are better equipped to make informed decisions and mitigate potential losses.

Also Read: The Ultimate Guide: A Step-by-Step Tutorial on How to Buy Bitcoin

Conclusion

The July 2024 cryptocurrency market crash has been a stark reminder of the volatility and risks inherent in the crypto space. While the immediate impact has been severe, the long-term prospects for cryptocurrencies remain promising. By addressing regulatory challenges, fostering technological innovation, and promoting investor education, the market can recover and continue to evolve. As always, investors should approach the market with caution, armed with knowledge and a clear understanding of the risks involved.

FAQs

What caused the July 2024 cryptocurrency market crash?

Increased regulatory pressures caused the July 2024 cryptocurrency market crash, macroeconomic factors such as rising interest rates and inflation concerns, market manipulation by large holders (whales), negative technical indicators, and issues related to exchange outages during high volatility periods.

How much did the global cryptocurrency market capitalization drop during the crash?

During the July 2024 crash, approximately $90 billion was erased from the global cryptocurrency market capitalization within hours.

Which cryptocurrencies were most affected by the crash?

While Bitcoin experienced significant declines, many altcoins, especially those with smaller market caps, faced even steeper losses. Altcoins with higher volatility saw larger percentage drops compared to Bitcoin.

How did regulatory changes contribute to the market crash?

Increased regulatory scrutiny and the introduction of stricter regulations on cryptocurrency trading and taxation in various countries created uncertainty and fear among investors. This led to panic selling, contributing to the market crash.

What role did macroeconomic factors play in the crash?

Macroeconomic factors, such as rising interest rates, inflation concerns, and fears of a global recession, prompted investors to shift their capital away from high-risk assets like cryptocurrencies, exacerbating the sell-off in the market.

What is market manipulation, and how did it affect the crash?

Market manipulation refers to the actions taken by large holders (whales) to influence market trends by executing large buy or sell orders. In July 2024, several whale accounts offloaded substantial amounts of Bitcoin and altcoins, triggering a chain reaction of sell orders from retail investors and trading bots, intensifying the market decline.

How did technical indicators and sentiment influence the crash?

Technical indicators showed a bearish trend with key support levels for Bitcoin and major altcoins being breached. This loss of technical support, combined with negative sentiment on social media and crypto forums, amplified fears and led to increased selling pressure.

What immediate impact did the crash have on the cryptocurrency market?

The immediate impact included a sharp decline in market capitalization, significant price drops for Bitcoin and altcoins, increased Bitcoin dominance, extreme volatility in altcoin prices, and a heightened sense of caution among investors.

What can investors learn from the July 2024 market crash?

Investors can learn the importance of regulatory awareness, the impact of macroeconomic factors, the risks associated with market manipulation, the significance of technical analysis, and the need for robust risk management strategies. Enhanced investor education is crucial for navigating the volatile crypto market.

How might the cryptocurrency market recover from this crash?

The market might recover through regulatory clarity, technological innovations, historical recovery patterns, and improved investor education. Effective regulation, advancements in blockchain technology, and increased understanding of market dynamics can contribute to a stable and growing cryptocurrency market.

What steps can investors take to protect their assets in future crashes?

Investors can protect their assets by diversifying their portfolios, staying informed about regulatory developments, using stop-loss orders to limit potential losses, avoiding excessive leverage, and conducting thorough research before investing.

Are there any long-term positive outcomes from the crash?

Yes, the crash can lead to more robust regulatory frameworks, encourage technological innovations in the crypto space, and highlight the importance of investor education. These outcomes can contribute to a more mature and resilient cryptocurrency market in the long run.

How does Bitcoin’s dominance change during market crashes?

During market crashes, Bitcoin often increases its dominance over the market as it tends to be perceived as a more stable asset compared to altcoins. This is because Bitcoin is the most established cryptocurrency with the largest market cap and liquidity, leading investors to shift capital into Bitcoin during periods of market uncertainty.